We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Richard Wallis

Richard Wallis

Head of Research and Investment

Introduction

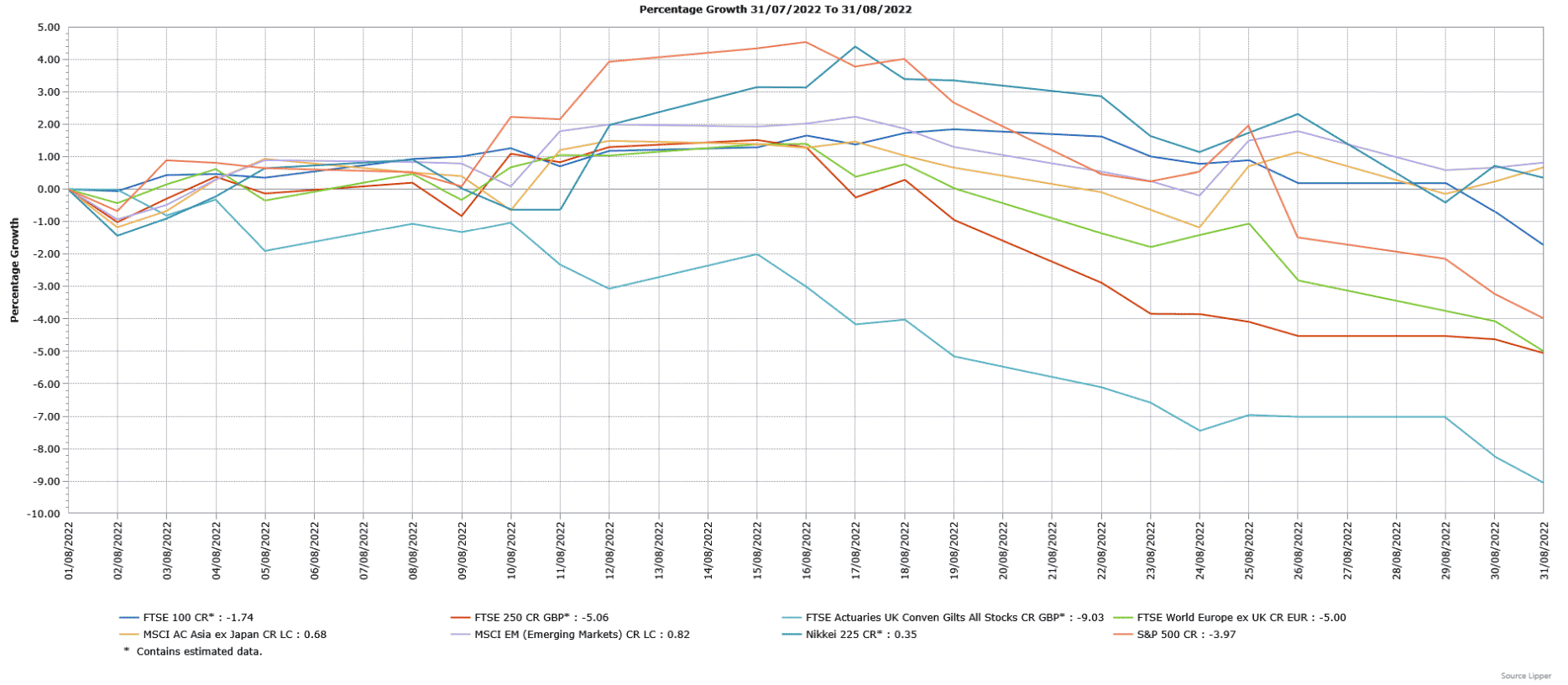

Developed global equity markets endured a difficult August, driven by falls in the second half of the month. Investor sentiment was depressed by concerns over increasingly aggressive interest rate rises and their impact on economic growth, together with the ongoing fears over rising costs. Developed market finished lower, but there was more resilience in Asian and Global Emerging Markets. Fixed Income suffered in particular, with UK gilts ending August sharply lower.

Economic Overview

UK

Interest rates and inflation

The Bank of England (BoE) raised interest rates by 0.5% to 1.75%, the largest increase since 1995 with rates now at their highest level since late-2008. The rise was driven by the BoE’s need to stop surging inflation from becoming more embedded. The Monetary Policy Committee (MPC) voted 8-1 to raise rates by 0.5%, with the lone voter Silvana Tenreyro preferring a smaller 0.25% increase, whilst the larger hike was in line with expectations.

It was highlighted by the BoE Governor Andrew Bailey that there was an exceptionally large amount of economic uncertainty and that all options are open to the MPC at the September meeting and beyond, though there was no preset path. Mr Bailey said “Returning inflation to the 2% target remains our absolute priority,” adding “There are no ifs or buts about that”.

Mr Bailey noted that feedback from business leaders and the BoE’s own surveys showed inflationary pressure building in the labour market due to the severe shortage of job candidates. In addition to the increase in interest rates, the BoE said it expected to start selling down its significant stockpile of government bonds, currently worth £844 billion, shortly after its September meeting through active sales of around £10 billion a quarter.

In its August Monetary Policy Report, the BoE forecasted that inflation would peak at over 13% in the fourth quarter, primarily due to the surge in energy prices following Russia’s invasion of Ukraine.

A contracting economy

The BoE also warned the UK would fall into recession at the end of this year, with the economy contracting in the final quarter and would keep shrinking until the end of 2023. Whilst the projected recession would be the longest since 2008, it is not forecasted to be as deep as the one that followed the Global Financial Crisis.

Official data showed the UK economy contracted in the second quarter of this year, partly due the ending of the Covid schemes such as Test and Trace. However, the contraction in the month of June wasn’t as bad as expected. The Office for National Statistics (ONS) said the economy fell 0.6% in June, the biggest contraction since January 2021, but not as bad as the forecasted 1.3% decline.

Whilst June was impacted by unusually having two bank holidays due to Queen Elizabeth’s Platinum Jubilee, the winding down of the Covid-19 health services was the main negative contributor. For the second quarter, the ONS said the British economy contracted by 0.1%, sharply lower than the 0.8% expansion in the first quarter although it was better than the forecasted 0.3% fall.

Private sector activity

In more timely data on the UK economy, a closely watched survey showed that activity in Britain’s private sector barely expanded in August. The S&P Global flash composite Purchasing Managers’ Index (PMI) measures activity in the services sector and manufacturing and is an estimate for the full month as it is provided before the end of the period and as such, is not based on the entire range of survey responses. The flash composite PMI fell from 52.1 in July to 50.9 in August, the weakest pace of expansion for 18 months and just above the 50-mark separating expansion from contraction.

Respondents often linked the loss of momentum to relatively muted customer demand, as well as shortages of both labour and inputs. The fall was driven by a faster decline in manufacturing, whilst the services sector was more resilient. UK manufacturers suffered a sharp fall in production during August, with the rate of reduction the quickest since May 2020. New business in the private sector rose only slightly in August, with the rate the slowest for 18 months, with services companies driving the growth.

The survey data indicated a further easing in the rate of input cost inflation across the private sector and whilst the overall pace remains sharp, it was the softest in nearly a year. Manufacturers saw a notable easing in the pace of input cost inflation, with lower prices for some commodities such as metals helping ease overall pressures.

In the service sector the rate of cost inflation picked up slightly, with respondents noting higher salaries as well as increased costs for energy and fuel. Average prices charged by British firms also rose at a slower pace overall, with the rate easing to a seven-month low, which was noted as often being due to intense competition and efforts to attract new work. The flash services PMI edged lower from 52.6 in July to 52.5 in August, an 18-month low, whilst the flash manufacturing PMI fell into contraction, with the reading dropping from 52.1 to 46.0, a 27-month low. Furthermore, manufacturing output fell deeper into contraction, falling from 48.9 to 42.4.

Government borrowing

British government borrowing, which is the difference between spending and tax income, was higher than expected in July. The ONS said that public sector borrowing excluding state-owned banks was £4.944 billion in July, which was well ahead of the Office for Budget Responsibility’s March forecast of a deficit of just £0.2 billion, as well as economists forecasted borrowing of £2.8 billion. July is normally a month that sees higher flows of income tax payments.

For the first four months of the 2022/23 financial year (April to July), borrowing was £55 billion, £12.1 billion less than the same period last year but £32.6 billion higher than the same period in 2019. There was a downward revision of £5 billion to the shortfall between April and June. The rise in inflation continues to increase the government’s debt interest costs, with £5.8 billion paid in July, 63% higher than last year.

Unemployment and labour statistics

British unemployment held steady at 3.8% in the three months to June, despite the concerns over the strength of the economy. The number of people in work rose by 160,000 in the three months to June, but this was sharply lower than the forecasted 256,000 increase. The number of unemployed people rose slightly, due to people returning to the labour market to look for jobs.

Vacancies in the three months to July fell for the first time since mid-2020, although at 1.274 million they remained near their record high. The ONS said growth in regular pay excluding bonuses in the second quarter was 4.7% higher, ahead of the 4.3% in the previous three-month period, but when adjusted for inflation was 3% lower, a record fall. Employee’s average total pay, which includes bonuses, was 5.1% higher but this represented a 2.5% fall when adjusted for inflation.

Inflation

UK inflation, as measured by the Consumer Price Index (CPI), jumped from 9.4% in June to 10.1% in July, making the UK the first out of the Group of Seven countries (Canada, France, Germany, Italy, Japan, the UK and the US) to see price growth reach double-digits. The increase to 10.1% was above all forecasts with the consensus being 9.8%.

The main reason for the jump in inflation from June to July was a 12.6% rise in annual food and non-alcoholic drink prices, the biggest since 2008, whilst higher energy and petrol prices were the biggest driver over the year as a whole. The ONS said bread, cereals, milk and cheese, as well as ham, bacon, vegetables and confectionery, were some of the foodstuffs rising most in price. Takeaway meal costs were higher, whilst prices rose for package holidays.

Although the prices charged by factories rose by the most since 1977, surging 17.1%, the increase in prices paid by factories eased slightly from June’s record 24.1% to an annual rate of 22.6%. The month-on-month increase was the smallest so far in 2022 at 0.1%, due primarily to weaker global demand for steel and a fall in crude oil prices.

Retail sales

British retail sales were higher than expected in July, with growth being driven by online shopping deals. Retail sales volumes, adjusted for inflation and the time of the year, rose 0.3% in July, well above the forecasted 0.2% fall and the small decline in June. However, sales volumes in May and June were revised lower, meaning that volumes fell 1.2% over the three months to July. The ONS said retailers had reported that sales were boosted by a range of offers and promotions.

The increase in sales was driven by a 4.8% jump in online and mail order volumes, the biggest monthly increase since December. Online sales were likely supported by Amazon’s annual Prime Day, although the ONS said there was also greater spending at a range of online retailers, especially for household goods. However, other retailers endured a more difficult month, with food sales only 0.1% higher having previously been boosted in June from the Jubilee celebrations. Clothing sales were 1.2% lower, whilst motorists bought 0.9% less fuel, which the ONS attributed to less people driving during the heatwave.

Consumer Confidence

Research firm GfK said that their Consumer Confidence Index fell from -41 in July to a record low of -44 in August, below the forecasted smaller drop to -42. GfK said British households were feeling “a sense of exasperation” about the surging cost of living, with their assessment of their personal finances and the general economic situation declining, both over the past 12 months and for the year ahead.

US

Interest rates

At the Jackson Hole central banking conference in Wyoming, the Federal Reserve Chair said in a speech that the central bank will raise interest rates as needed to restrict growth and would keep them there “for some time” to bring down inflation that is running at more than three times the target level. Mr Powell added “Reducing inflation is likely to require a sustained period of below-trend growth”.

Furthermore, Mr Powell highlighted that whilst higher interest rates, slower growth and softer labour market conditions would reduce inflation, they will also bring some pain to households and businesses. Mr Powell noted that these are the unfortunate costs of reducing inflation, but a failure to restore price stability would result in greater pain.

Mr Powell also warned that as the pain increases, people should not expect the Federal Reserve to reduce interest rates quickly until the inflation issue is resolved. It was viewed that the Federal Reserve policymakers were signalling that even a recession would not affect the path of interest rates if inflation was not convincingly returning to target.

The US economy contracts

The second estimate of US economic growth in the second quarter showed a smaller contraction than the preliminary estimate, as upwardly revised consumer spending offset part of the negative impact from the slower pace of inventory accumulation. In its second estimate, the Commerce Department said the US economy contracted at an annualised rate of 0.6% in the second quarter, which was an upward revision to the initial 0.9% decline and ahead of the forecasted 0.8% decline.

The US economy contracted by 1.6% in the first quarter. Whilst the two consecutive quarters of contraction meets the technical definition of a recession, in the case of the US economy this is misleading given the large impact of supply chain issues on inventories, where unfinished products are not included in the economic data.

The National Bureau of Economic Research, which is the official arbiter of recessions in the US, defines a recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators, where in some cases the data remains strong.

The private sector

S&P Global said US private sector activity contracted again in August, with services businesses in particular seeing weakening demand amid high inflation and tighter financial conditions. The flash composite PMI fell from 47.7 in July to 45.0 in August, a 27-month low and a second consecutive monthly decline. The contraction was broad-based, with both manufacturers and services businesses recording lower activity, with the latter seeing the steepest decline.

Customer demand was hit by material shortages, delivery delays, rising interest rates and strong inflationary pressures. Overall sales fell as both manufacturers and services providers struggled with the subdued demand conditions.

The rate of input cost inflation eased for a third consecutive month as input prices rose at their slowest pace for a year-and-a-half, although they remained at a historically high level. Firms increased their selling prices at the slowest pace for 18 months, which was again linked to efforts to offer concessions to customers whilst the overall pace still remains faster than in any period prior to March 2021. The flash services PMI fell from 47.3 in July to 44.1 in August, a 27-month low, whilst the flash manufacturing PMI declined from 52.2 to 51.3, a 25-month low. Manufacturing output contracted for the second consecutive month.

Employment

US employment growth was stronger than expected in July, as employment rose above its pre-pandemic level and eased fears over the economy being in recession. The Labor Department’s closely watched employment report showed nonfarm payrolls added 528,000 jobs in July, the largest gain since February and well ahead of the forecasted increase of 250,000.

In addition, June’s reading was revised higher from a gain of 372,000 jobs to 398,000. The increase means overall the labour market has now recouped all the jobs lost during the pandemic, although government employment is still around 597,000 jobs lower.

The gains in jobs were led by the leisure and hospitality sector, which added 96,000, but employment in this industry remains 1.2 million workers below its February 2020 level. Professional and business services added 89,000 jobs, whilst there was a gain of 70,000 for the healthcare sector. Government employment also rose, boosted by education, whilst there were also increases for construction and manufacturing payrolls.

The unemployment rate, which is obtained from the household survey, fell from 3.6% in June to 3.5% in July, although this was due to 63,000 people leaving the workforce, meaning it had declined for two consecutive months. With the labour market remaining tight, average hourly earnings rose 0.5% having increased 0.4% in June, meaning the year-on-year increase was 5.2%.

Inflation

US consumer prices eased in July, due to a sharp decline in the cost of gasoline. The Labor Department said the Consumer Price Index (CPI) was flat in July, following a 1.3% increase in June and below the forecasted 0.2% rise. This represented the largest month-on-month easing in the pace of price increases since 1973, with the cost of gasoline falling by around 20% since mid-June. Whilst the price of gasoline fell 7.7% in July, food price pressure remained elevated, rising 1.1% having gained 1% in June.

For the twelve months through July, CPI rose by a weaker than expected 8.5%, which followed the 9.1% jump in June. The so-called core CPI, which excludes volatile food and energy components, rose 0.3% in July, a 10-month low and follows a 0.7% gain in June. The easing in the pace of increases was helped by a near 8% fall in the cost of airline fares. Inflation in the cost of rent and owners’ equivalent rent of primary residence, which is what a homeowner would receive from renting a home, rose at almost the same pace as in June. Shelter costs comprise about 40% of the core CPI measure. For the 12 months through July, core CPI matched June’s 5.9% increase.

Retail sales

US retail sales were unexpectedly unchanged in July, slightly beneath the forecasted 0.1% gain, whilst June’s reading was revised lower from 1% to 0.8%. Retail sales, which are mostly goods, rose 10.3% on a year-on-year basis. Falling gasoline prices resulted in lower receipts at service stations, with sales declining 1.8%, whilst receipts at auto dealerships dropped 1.6%.

However, lower gasoline receipts did mean there was spare cash for spending on other goods, as excluding gasoline and motor vehicles retail sales were 0.7% higher. There were though falls in sales at clothing and general merchandise stores, but online and mail-order sales rose 2.7%, likely boosted by Amazon’s Prime Day. Sales at building material and garden equipment rebounded 1.5% having fallen in June, whilst receipts at furniture stores and electronics and appliances stores were also higher. Receipts at restaurants and bars, the only services category in the retail sales report, edged 0.1% higher.

The so-called core retail sales, which exclude automobiles, gasoline, building materials and food services and correspond most closely with the consumer spending component of GDP, rose 0.8% in July, whilst June’s gain was revised lower from 0.8% to 0.7%.

Consumer spending

The Commerce Department said consumer spending, which accounts for more than two-thirds of the US economy, hardly rose in July as falling gasoline prices weighed on sales at service stations. Consumer spending rose 0.1% in July, below the forecasted 0.4% gain and follows a 1% increase in June. The lower receipts at service stations freed up money for spending on motor vehicles, clothing, recreational goods, furniture and housing and utilities, but overall goods expenditure still fell 0.2% having jumped 1.5% in June. Spending on services rose 0.3%, helped by moderate gains in receipts at restaurants and bars as well as recreation services, but still lagged the 0.7% gain in June.

Europe

Eurozone growth

The European Union’s Statistics Office, Eurostat, said that growth in the Eurozone economy in the second quarter wasn’t quite as strong as previously estimated. Eurostat lowered its previous estimate of 0.7% quarter-on-quarter to 0.6%, whilst the year-on-year growth figure was reduced from 4% to 3.9%. Growth in the second quarter was broadly due to strong performances from Italy and Spain, whilst at the time of the estimate, there was stagnation in the biggest economy Germany.

Inflation

Eurostat’s preliminary estimate of inflation in the Eurozone showed that prices rose to another record high in August. Consumer price growth in the 19 countries sharing the euro rose from 8.9% in July to 9.1% in August, just above the smaller forecasted increase to 9%. Energy costs remained elevated, whilst food prices continued to accelerate. Prices also rose faster for services and non-energy industrial goods. Inflation excluding volatile energy prices rose from 5.4% to 5.8%, whilst an even narrower measure that also excludes food, alcohol and tobacco increased from 4% to 4.3%.

Germany

Revised data from the Federal Statistics Office showed the German economy unexpectedly grew in the second quarter. Europe’s largest economy expanded by 0.1% quarter-on-quarter, slightly ahead of the forecasted no growth that was in line with the preliminary estimate. Economic growth was supported by household spending, which rose 0.8% compared with the first quarter despite high inflation and the energy crisis. Government spending was also higher. The German economy grew by 1.7% on a year-on-year basis.

Preliminary survey data showed the downturn in the German private sector deepened in August, with businesses noting a combination of factors including uncertainty, high inflation and rising interest rates. The S&P Global flash composite PMI fell from 48.1 in July to 47.6 in August, a 26-month low that reflected a deepening decline in services sector activity.

The data showed strong headwinds to demand, with inflows of new business declining for a third consecutive month, although the pace did ease from July. Weaker export sales were a key driver of lower new business, with goods producers recording the steepest drop in new business from abroad for over two years. High stock levels at customers also weighed on new orders across the manufacturing sector.

The survey indicated continued cost pressures, with a number of respondents highlighting elevated energy prices and higher wages. The overall rate of input cost inflation did ease for the fourth consecutive month, but remains well above its historical average. Manufacturers noted an easing in some materials prices and a reduction in supply chain bottlenecks. Average prices charged for goods and services continued to rise sharply, although the rate also eased for the fourth consecutive month. The flash services PMI fell from 49.7 in July to 48.2 in August, an 18-month low, but the flash manufacturing PMI rose from 49.3 to 49.8, a two-month high.

France

France’s INSEE statistics body said the French economy expanded 0.5% in the second quarter, in line with its preliminary estimate and confirming its recovery from the 0.2% contraction in the first three months of this year. Household consumption rebounded in the second quarter, notably in accommodation and food services which benefited from the lifting of Covid restrictions. There was also a positive contribution from foreign trade and inventory changes. However, gross fixed capital formation (also known as investment) rose by less than originally expected. On an annual basis, the French economy grew by 4.2% in the second quarter, also in line with the preliminary estimate.

French private sector activity fell into contraction in August, the first decline since the pandemic-related disruptions at the beginning of 2021. The downturn was only marginal and driven primarily by manufacturing, although service sector growth was also weaker. The S&P Global flash composite PMI fell from 51.7 in July to 49.8 in August, an 18-month low.

The survey showed that demand was the main drag on output, due to a broad-based fall in new business orders that was the sharpest since November 2020, with manufacturers seeing the biggest decline. There was a further easing in the pace of both input cost and output price inflation, with the former increasing at its slowest rate in six months whilst the latter saw its weakest rise so far this year. The flash services PMI fell from 53.2 in July to 51.0 in August, a 16-month low, whilst the flash manufacturing PMI remained in contraction, declining from 49.5 to 49.0, a 27-month low. In addition, manufacturing output fell further into contractionary territory with its reading of 44.4, also a 27-month low.

Asia and Emerging Markets

Japan

The Japanese economy rebounded in the second quarter from its Covid-19 related downturn at a weaker than expected pace. The world’s third largest economy expanded at an annualised rate of 2.2% in the second quarter, the third consecutive quarterly increase but behind the forecasted 2.5% gain.

Growth in the first quarter was revised to a gain of 0.1%, as the surge in Covid-19 cases weighed on spending. The expansion in the second quarter was driven by a 1.1% gain in private consumption, with restaurants and hotels seeing a recovery in demand following the lifting of restrictions, although this was lower than the forecasted 1.3% increase. Capital expenditure was another key driver, increasing 1.4% from the previous quarter, which was well ahead of the forecasted 0.9% gain.

China

The National Bureau of Statistics (NBS) said that China’s factory activity remained in contraction in August, with production hit by new Covid-19 outbreaks, the worst heat wave in decades and the crisis in the property sector. The official manufacturing PMI rose from 49.0 in July to 49.4 in August, slightly ahead of the forecasted smaller increase to 49.2. The sub-index for output was unchanged and as such also remained in contraction territory, with a power crunch weighing on production.

The new export orders sub-index rose, but remained below the 50-mark separating expansion from contraction. The official non-manufacturing PMI fell from 53.8 in July to 52.6 in August, partly due to the extreme heat resulting in the suspension of some construction work. The official composite PMI, which includes both manufacturing and services activity, fell from 52.5 in July to 51.7 in August. The official PMI surveys focus on the largest sample of companies, although the majority are big and state-owned enterprises.

China’s export growth was stronger than expected in July, rising 18% compared to a year earlier, slightly above the 17.9% gain in June and ahead of the forecasted 15% increase. Foreign trade container throughput at eight major Chinese ports rose 14.5% in July, well above the 8.4% gain in June. Exports are also likely to have been supported by pent-up demand from Southeast Asia, helped by easing in supply chain issues and an increase in factory production. However, imports were weaker than expected, rising 2.3% from a year earlier and though ahead of June’s 1% gain, they were lower than the forecasted 3.7% increase. Crude oil imports were notably lower, with fuel demand recovering more slowly than expected due to further Covid-19 outbreaks.

China’s industrial production rose 3.8% in July compared with the previous year, slightly slower than the 3.9% gain in June and well below the forecasted 4.6% increase. Retail sales data also disappointed, rising by 2.7% in July from a year ago, below both the 3.1% gain in June and the forecasted 5% growth. Following new outbreaks of the Omicron variant, the imposition of further lockdown measures in July weighed on activity.

Hong Kong

Government data showed Hong Kong’s economy contracted by 1.3% on an annual basis in the second quarter of this year, a slight improvement on the advance estimate of a 1.4% decline. The downturn was due to weak performance in external trade and represented the second consecutive quarter of year-on-year contraction. However, seasonally adjusted economic growth was 1% higher in the second quarter. Hong Kong’s economy remains under pressure from Covid-19 restrictions, which has weighed heavily on tourism as well as bars, restaurants and shops.

Indonesia

Indonesia’s second quarter economic growth was stronger than expected, helped by a boom in exports that was driven by higher commodity prices, benefiting its exports of palm oil, coal, nickel and tin. Official data showed the economy expanded by 5.44% compared with a year earlier, the fastest pace in a year and ahead of the forecasted 5.17% increase and the 5.01% annual growth in the first quarter.

Exports rose by nearly 20% compared with the year before, with the Indonesian Statistics Bureau referring to this performance as “impressive”. In addition, household consumption recovered following the lifting of Covid-19 restrictions, although investment slowed. Indonesia’s central bank unexpectedly raised its interest rate by 0.25% to 3.75%, the first increase since 2018 as it looks to combat annual inflation that rose in July by 4.9%, its fastest pace since the end of 2014.

India

India’s central bank, the Reserve Bank of India, raised its key interest rate by 0.5% to 5.4%, with forecasts having been split between a 0.25% and 0.5% rise. The Reserve Bank of India stated that inflation is projected to remain above the upper tolerance level of 6% through the first three quarters of 2022-23, increasing the risk of destabilising inflation expectations and triggering second round effects.

The Indian economy expanded 13.5% year-on-year in the second quarter, the highest growth rate in a year but below the forecasted 15.2% gain. Growth was driven by manufacturing and services, including accommodation and travel. Investment growth was also stronger, but there was a slowdown in state spending. Consumer spending, which represents over half of India’s economic activity, remained strong despite sharply higher food and fuel prices. Net foreign demand was a negative contributor as imports rose at a much quicker rate than exports.

Thailand

Thailand’s central bank raised its key interest rate for the first time since May 2020, aiming to combat surging inflation. The Bank of Thailand raised its interest rate by 0.25% to 0.75%, as inflation remained near 14-year highs. In addition, the Bank’s Monetary Policy Committee said further increases would be carried out “in a gradual and measured manner consistent with the growth and inflation outlook”.

Thailand’s economy expanded at its fastest pace in a year in the second quarter, as an easing in Covid-19 restrictions boosted activity and tourism. Southeast Asia’s second largest economy grew at an annual rate of 2.5% in the second quarter, ahead of the 2.3% in the previous three-month period but below the forecasted 3.1% expansion. The slightly slower pace of growth was thought to be due to lower investment and the previous year’s high base of 7.7% annual growth. On a quarterly basis, the economy expanded a seasonally-adjusted 0.7% in the second quarter, below the forecasted 0.9% growth and the revised 1.2% gain in the first three months of the year.

Singapore

The Ministry of Trade and Industry (MTI) lowered its original estimate for economic growth in Singapore in the second quarter from 4.8% year-on-year to 4.4%. The weaker growth was partly due to a slowdown in electronics manufacturing, with the MTI also stating that weakness in China’s economic outlook, a key market for petroleum and chemicals products, had weighed on growth prospects. On a quarter-on-quarter seasonally adjusted basis, the Singapore economy contracted 0.2%, below the preliminary estimate of 0% and the 0.8% expansion in the first quarter.

Taiwan

The preliminary estimate for Taiwan’s economic growth in the second quarter was revised slightly lower from an annualised 3.08% to 3.05%. In addition, growth for 2022 was revised lower from 3.91% to 3.76%, much slower than the 6.45% seen in 2021 although this was the fastest rate since 2010. Although exports are expected to increase at a slower rate, demand for semiconductors is projected to remain strong. It was noted that China’s lockdown measures due to Covid-19 were weighing on activity.

Malaysia

Malaysia’s economy expanded at its fastest annual pace in a year in the second quarter, supported by growth in domestic demand and resilient exports. The economy jumped 8.9% from a year earlier in the second quarter, above both the 5% annual rise in the previous three months and the forecasted 6.7% gain. Malaysia’s economy grew 3.5% on a seasonally adjusted basis in the second quarter compared with the previous three months.

South Korea

As expected, South Korea’s central bank raised its interest rate by 0.25% to 2.5%, whilst significantly increasing its inflation forecasts from 4.5% to 5.2% for this year, which would be the fastest rate since 1998. The central bank’s Governor said fighting inflation remained the priority, noting that market expectations about the rate reaching 2.75% or 3% by the end of the year “still looks appropriate”, although he warned this would need to be reviewed if growth weakened sharply.

Brazil

In line with expectations, Brazil’s central bank raised interest rates by 0.5% to 13.75%, the highest level since January 2017. Policymakers said the decision reflects the uncertainty over the potential scenarios for prospective inflation, with a higher than usual variance in the balance of risks. In the forward guidance, the Committee said it will evaluate the need for another increase of a smaller magnitude at its next meeting in September.

Mexico

The national statistics agency INEGI said the Mexican economy expanded 0.9% in the second quarter compared with the previous three months, slightly below the forecasted 1% gain. All three major sectors, including the primary, manufacturing and services, grew 0.9%. The Mexican economy grew 2% on a year-on-year basis, ahead of the 1.8% gain in the first quarter but just beneath the preliminary estimate of a 2.1% expansion.

Turkey

Turkey’s central bank unexpectedly cut its interest rate by 1% to 13%, with forecasts being for the rate to remain unchanged at 14%. This was the first cut in interest rates following seven consecutive decisions to make no changes. The central bank said that decision to reduce rates was to drive economic growth and sustain employment, amid growing geopolitical risk. The central bank added that rising loan rates have diminished effectiveness of monetary policy. Furthermore, the decision to reduce the interest rate came despite inflation rising to nearly 80% in July.

Broadly in line with expectations, Turkey’s economy grew 7.6% year-on-year in the second quarter, driven by strong domestic demand and exports, which have benefited from the fall in the lira. The economy expanded 2.1% compared with the previous quarter on a seasonally and calendar-adjusted basis.

Russia

Preliminary data showed Russia’s economy contracted by 4% year-on-year in the second quarter and whilst no further details were provided, it is expected that the decline was caused by weaker consumer demand and the impact of sanctions. However, the contraction wasn’t as bad as the forecasted 7% drop.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK markets fell in August, with the FTSE 100 outperforming the FTSE 250 and many other developed markets as it suffered a smaller decline. Investor sentiment was hit by fears over more aggressive interest rate rises, with the Bank of England raising rates during the month, as well as concerns over higher inflation over the coming months. The FTSE 100 was more resilient as it benefited from its large exposure to energy and banking sectors, whilst there was underperformance from consumer-related areas.

Despite rising in the first half of the month, the US S&P 500 still finished August sharply lower due to concerns over more aggressive interest rate rises, particularly after the Federal Reserve reiterated its commitment to combating inflation. European markets also fell, as shown by the broad FTSE World Europe ex UK Index, with sentiment hit by ongoing concerns regarding inflation, notably towards high gas and electricity prices, as well as fears over bigger interest rate increases. The Japanese Nikkei 225 Index proved more resilient as it ended August with a nominal gain, supported by strong quarterly results, hopes that US inflation might soon be peaking and conversely, signs there could be more sustained, but moderate inflation in Japan after decades of deflation.

Asian markets were more resilient to the fears over rising interest rates, with the broad MSCI Asia ex Japan Index posting a small gain in August. India led the gains, whilst China was broadly unchanged with Hong Kong underperforming other regional indices. Global Emerging Markets outperformed developed markets, as demonstrated by the gain for the broad MSCI Emerging Market Index. Turkey was a very strong performer, but Emerging Asia was the leading region, followed by Latin America and EMEA (Emerging Europe, the Middle East and Africa).

Fixed income suffered a very difficult August as prices fell and yields rose sharply (fixed income prices and yields have an inverse relationship), as inflation remained high and central banks reiterated their commitment to raising interest rates. Gilts (FTSE Actuaries UK Conventional Gilts Index) endured significant monthly losses as they underperformed corporate bonds. Sentiment towards gilts was hit not only by the expected interest rate rises and high inflation, but also by the decline in sterling and political uncertainty combined with the anticipated fiscal response to the energy crisis that was likely to be funded by increased borrowing.

This update is intended to be for information only and should not be taken as financial advice.

Short-term Key Dates

• 2nd September – US Non-Farm Payrolls for August

• 7th September – Eurozone GDP 2nd Quarter Third Estimate

• 8th September – Japan GDP 2nd Quarter Final Estimate

• 8th September – European Central Bank Interest Rate Decision

• 12th September – UK Monthly GDP for July

• 13th September – UK Labour Market Statistics

• 13th September – US Inflation for August

• 14th September – UK Consumer Price Indices (Inflation) for August

• 16th September – UK Retail Sales Data for August

• 21st September – UK Public Sector Finances for August

• 21st September – US Federal Reserve Interest Rate Decision

• 22nd September – Bank of Japan Interest Rate Decision

• 22nd September – Bank of England Interest Rate Decision

• 23rd September – UK Gfk Consumer Confidence for September

• 23rd September – UK Flash PMIs for September

• 29th September – US GDP 2nd Quarter Final Estimate

• 30th September – UK GDP 2nd Quarter Final Estimate

• 7th October – US Non-Farm Payrolls for September

• 11th October – UK Labour Market Statistics

• 12th October – UK Monthly GDP for August

• 13th October – US Inflation for September

• 18th October – China GDP 3rd Quarter

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA8533 Exp 09/2023

[ Date Posted: 21/09/2022 12:03:51 ]